Net working capital is a measure of a company’s operating liquidity and its ability to meet short-term obligations and fund the operations.

Net working capital is a measure of a company’s operating liquidity and its ability to meet short-term obligations and fund the operations.

What is EBITDA? More importantly, what is your EBITDA? Here’s how to calculate it and why it’s so important to every business owner.

When creating a confidential information memorandum (CIM), it’s essential to put together a deal team who can frame the CIM from the right perspective.

Whether a business owner is interested in selling now or in the future, it is never too early to have an experienced deal team in place.

Selling a business for the first time? You need to understand the components of the acquisition purchase agreement. This article will walk you through it.

This article on transitioning a business to the next generation by Albert D. Melchiorre and Evan J. Lyons was originally published in Smart Business.

How to understand the basic components of a deal structure and how they align with various seller objectives.

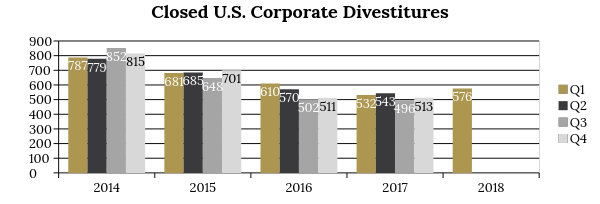

This article on corporate divestiture trends by Matthew M. Sweet and Marc A. Fleagle was originally published in Smart Business.

How to renew your focus on core businesses while simultaneously creating shareholder value by keeping up with changing trends in corporate divestitures.

You never get a second chance to make a first impression. Here are specific things you can do to maximize value during an M&A transaction.