For a company that would like to renew its focus on core businesses while simultaneously creating shareholder value, a corporate divestiture may be an excellent strategy. Corporate divestiture transactions occur when companies sell non-core business units or assets, which can generate cash that can be used to make new investments, pay dividends, buy back shares of stock, pay down debt, or simply increase capitalization.

In a constantly changing business environment, management teams frequently execute corporate divestitures in order to create value from assets or business units that do not fit their go-forward strategy. A good example is Allergan’s divestiture of its global generic pharmaceuticals business to Teva Pharmaceuticals in 2016, the largest in history. The divestiture allowed Allergan to focus on its goal of becoming the leader in branded pharmaceuticals, while simultaneously providing proceeds for acquisitions and commencement of a share repurchase program.

Keeping Up With Changing Trends in Corporate Divestitures

At MelCap, we’ve started to notice a shift in corporate divestiture activity.

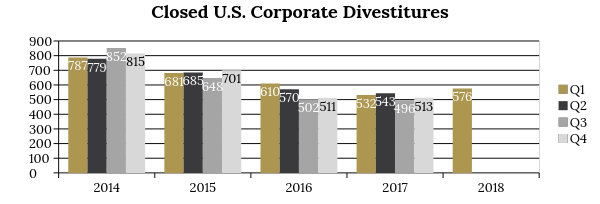

Quarterly divestitures have been declining over the previous year’s quarter since Q3 2014 at a rapid rate, largely following the overall decline in M&A transactions. In the first quarter of 2018, there were 576 divestiture transactions closed. Compare this to the first quarter of 2017 when there were 532 transactions closed and you can see the potential rebound that is occurring in the divestiture market.

Most notably during the quarter, Rite Aid sold 1,932 of its stores to Walgreens for $4.2 billion, and Nestle carved out its U.S. confectionery business to Ferrero International for 2.8 billion. Meanwhile, International Paper sold its North American consumer packaging business to Graphic Packaging for $1.1 billion.

What is the driver behind this divestiture turnaround? We believe it boils down to the imbalance in the supply and demand of M&A deals, which has resulted in elevated valuations across all sectors. The imbalance, fueled by significant buy-side purchasing power, has been met with a limited inventory of quality companies for sale. As a result, buyers have become increasingly competitive when bidding on quality assets, driving valuation multiples higher.

Over the last two quarters, management teams have increasingly taken notice of this highly competitive environment and have divested non-core businesses for premium multiples.

How Can Businesses Prepare for a Corporate Divestiture?

To prepare for a successful corporate divestiture, management teams need to pre-sale plan before the business or asset is marketed. As with any M&A transaction, pre-sale planning is absolutely essential. Part of pre-sale planning in a divestiture transaction is readying the business unit to be operated as a stand-alone entity post-close. This process involves analyzing the unit’s employees, systems, and operations to identify places that need work in order to operate independently of the parent company.

The division must have bench strength in the form of an excellent management team that will stay on board after the divestiture and continue to run the business. There must be proper operational and back office support for the divested entity to run independently. It also needs to have separation from its parent company in terms of having its own healthcare or benefits. Pre-sale planning will identify issues that prevent the business from running independently so that they can be resolved, boosting the value of the asset.

How MelCap Helps with the Divestiture Process

MelCap has the requisite knowledge and expertise to help clients pre-plan for a divestiture and can help identify opportunities and risks that a seller may not consider. In addition, MelCap has a successful track record of successfully completing corporate divestiture transactions for our clients. Please contact us to learn more.

Photo Source: S&P Capital IQ